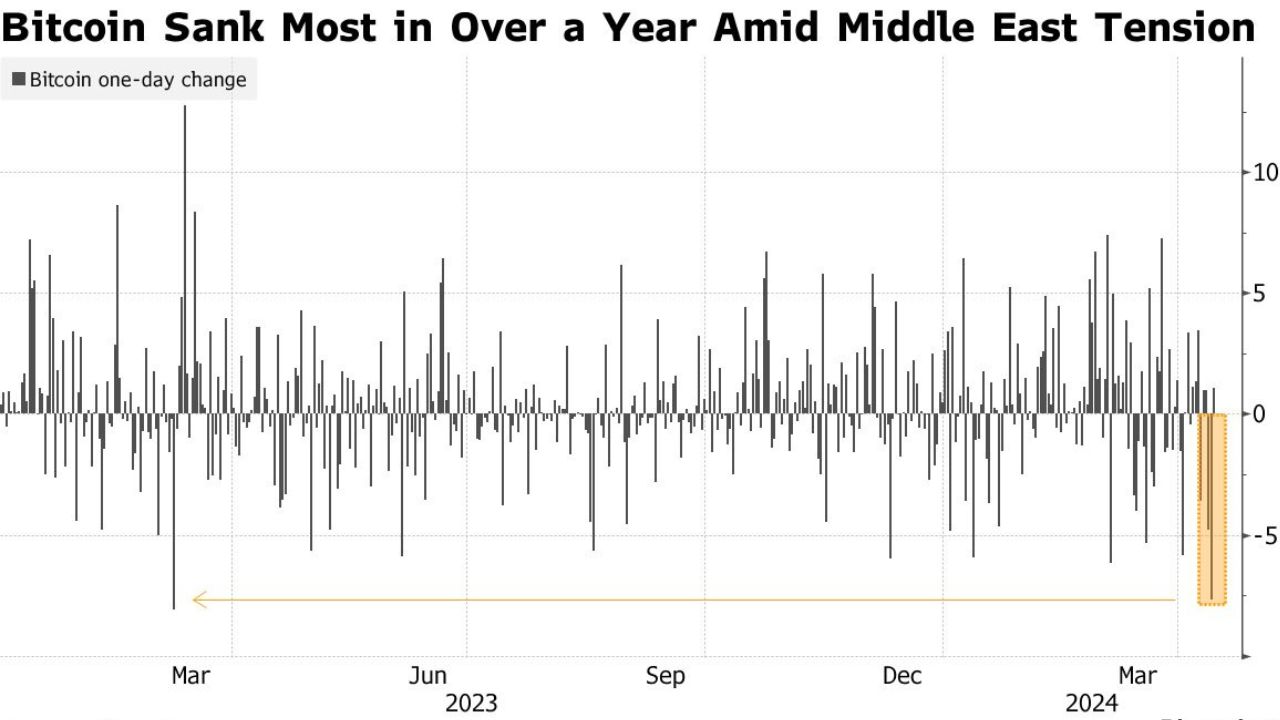

Late on Saturday night, Bitcoin saw an 8% decline as American officials verified the impending attack. During the weekend, digital currencies were among the few riskier assets that were traded, and their decline was interpreted as a first response to the rise of tensions in the Middle East. It had recovered to trade above $64,000 by Sunday morning. There was also a lot of selling of other currencies, such as ether, with some seeing 10% declines. Amid an unprecedented Iranian drone and missile strike on Israel overnight on Saturday, the Bitcoin market saw significant selling.

Bitcoin Slumps 8% After Iran Attacks Israel:

Most Middle Eastern stock markets saw losses on Sunday as of 8:36 a.m. London time, Israel’s stocks gave up their early gains and were trading a little down.

After experiencing its worst selloff in almost a year, Bitcoin bounced back, signaling to investors that asset markets would likely see volatility as they process the possibility of a military upheaval in the Middle East.

The biggest cryptocurrency rose 8.3% earlier on Sunday, but as of 8:50 a.m. in London, it was up 3.9% to $64,40. More minor currencies, such as Uniswap and Polkadot, had over a 10% increase in value.

Iran launched attack drones and missiles on Israel, allegedly in retaliation for a strike in Syria that resulted in the deaths of critical Iranian military officials, marking the start of a dangerous new phase in the crisis in the region. Because Iran acted when most markets were closed, cryptocurrency traders were in a unique position where they were among the first to respond to a significant geopolitical event.

According to David Lawant, head of research at FalconX, “more investors than usual might be choosing to express their market views through crypto.”

The tension weakened equities on Friday and strengthened safe havens like Treasuries and the currency as Israel readied for a strike. According to Coinglass statistics, one of the largest two-day liquidations in at least six months occurred on Friday and Saturday, wiping away almost $1.5 billion in bullish cryptocurrency bets made through derivatives.

In the last three days, leverage “has gotten completely overwhelmed, so that’s caused prices to deteriorate” in digital assets, according to Ebtikar materially.

Most Middle Eastern stock markets saw losses on Sunday as of 8:36 a.m. London time, Israel’s stocks gave up their early gains and were trading a little down.

The idea that Bitcoin and other crypto assets provide refuge during times of conflict—a viewpoint frequently voiced by supporters of the asset class—would be put to the test by a serious military confrontation between Israel and Iran. Cryptocurrencies were only beginning to see a market collapse that would endure until the end of 2022, when Russia invaded Ukraine in the early months of that year.

Bitcoin has dropped from its peak of $73,798 set in mid-March. The coin reached an all-time high due to demand for certain US exchange-traded funds that debuted in January, although net inflows into the products have recently decreased.

The so-called Bitcoin halving, anticipated on April 20 and would cut the token’s fresh supply in half, is eagerly anticipated by cryptocurrency traders. Although there are rising concerns about whether a recurrence is inevitable, since Bitcoin recently reached a record top, historically, the halving has proven positive for prices.

Read Also – Iranian Israeli Drones. The Iranian Waves Attacks Strikes Out the History